Money Back

Ripped off by a broker

How brokers defraud: How to reverse a credit card or bank transfer transaction. We go into great detail about how to recover funds that have been stolen. What to do in such a circumstance, and where to look for assistance. How credit brokers trick their customers.

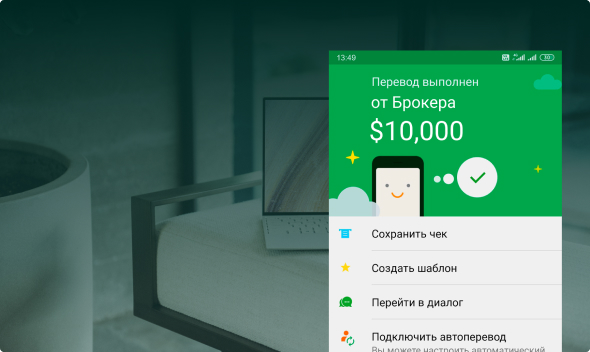

Money withdrawal from broker accounts

terms, conditions, and guidelines for money withdrawals from brokerage accounts. We provide thorough answers to all inquiries regarding the return of funds from brokerage accounts, including what to do in a similar circumstance, the rationale behind the broker’s refusal to do so, how to apply, and any potential nuances. On the website, users can receive free consultations.

Return money from the broker

You can independently apply to your bank with an application or request a chargeback consultation from experts in order to return the money from a dishonest broker. Even in the most challenging circumstance, we can assist you in getting your money back from the broker.

Chargeback

In the event of fraud, chargeback is a successful process to recover money. When using a credit card, chargebacks are used to protect the customer. You revoke the bank card transaction and forcibly return the funds from the merchant’s account by submitting an online application.