Euro exchange rate forecast for 2023

At the beginning of November 2023, another bearish week ended for the EUR-USD pair. The euro currency sank, losing 6% from its peak in the middle of the year. The values are record high – at the level of 1.05.

Why is the euro falling? First of all, it’s all about the strengthening of the dollar throughout the year. The United States Federal Reserve predicts another rate increase in the fourth quarter. According to him, next year there will be less easing. The fact is that the US economy has stabilized, and hydrocarbons are traded at high prices.

At the same time, the eurozone shows weaker economic prospects. In combination with slowing inflation, they suggest the end of the cycle of interest rate increases by the ECB.

The difference between interest rates benefited the dollar. With soft rhetoric, the ECB showed that there is nowhere else to raise the interest rate. The market understood this: they began to use Eurocurrency to finance carry trades.

Major players expect the rate to shift towards the dollar. That is, the value of the euro will decrease. But only on the condition that hydrocarbons continue to be sold at high prices and even increase until the end of the year.

Fundamental forecast for the euro exchange rate: what will happen to the currency

The ECB believes this: in the near future, at least until the end of the year, a rate increase is not expected. This is after 10 meetings in a year, at the end of which the rate increased to 4%. Expectations are based on the fact that September data showed a greater slowdown in inflation than expected.

Lagarde warns: the key rate may remain high for a long time. This is required to slow down inflation, and not for the euro to go up.

At the same time, according toLagarde, waiting too long could lead to a strong capital outflow from the eurozone national currency amid expectations of deterioration in the economy. We must not forget that the local economy is already showing weakness. Changes in the key rate appear in markets with a noticeable delay.

There is a risk of recession, or at best an economic slowdown. Therefore, expectations of a lower interest rate could add pressure on the euro from investors and traders.

When will the euro appreciate, according to Lagarde?

If it turns out that the EU economy has sunk to its maximum depth, the prospects for the national currency will increase. A rate cut will be one of the answers to the question “When will the euro appreciate?”. But even in this case there may be problems.

For example, in 2019, the ECB began to reduce rates faster than the Federal Reserve. This had an impact on the course. The dollar has strengthened strongly.

Why does the euro rate rise at a low rate?

Low interest rates mean cheap loans. This means there will be more people willing to receive them. Consequently, the demand for the euro will increase. This will lead to a strengthening of the currency.

When the rate rises, interest in lending in euros decreases. Borrowers are being replaced by carry traders who want to invest in a reliable currency at an increased interest rate. But such investments are always worse than lending. Because money doesn’t work that well. There is less demand for them.

Another reason, why the euro exchange rate has increased is the weakening of the US dollar, which lives by approximately similar rules. If the rates on the latter turn out to be high, the number of loans will decrease. Carry traders are unlikely to be able to compensate for this. Against the backdrop of a weak dollar, the euro will be stronger.

Technical analysis. What will the euro exchange rate be in 2023?

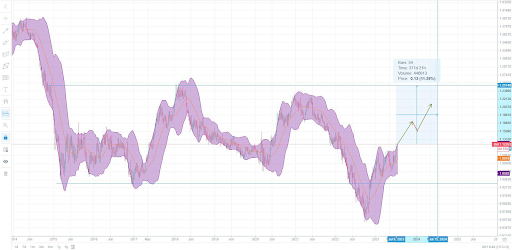

The one-week tick chart showed that the euro has had bad times over the past 11 weeks. The third quarter closed at 1.05. This is a very important level. Firstly, it reflects the critical support zone in March 2020, when the drawdown was very serious. In addition, it corresponds to the Fibonacci correction level – 38.2% of the jump from September 2022 to July 2023.

Despite the fact that the support level managed to keep the exchange rate from falling further, the bears dominate the market. The moment when the euro could fall even lower is already visible on the horizon.

The EU currency can be consistently lowered to the following levels:

- 1,045.

- 1,035.

- 1,022.

The Bears have this opportunity. At the last level, 61.8% Fibonacci of the July peak, mentioned above, is formed.

At the same time, it is difficult to say exactly how the euro exchange rate will change. If sentiment changes, it may turn towards buyers. This will give the eurozone currency an impetus for further growth.

RSI shows a bullish trend. This may activate European buyers. If they really want to, they will be able to:

- reach 1.06 to compensate for the short-term drawdown;

- storm the 200 SMA at 1.08.

The pair’s recovery is expected at 1.09. It can be considered resistance. What will the euro exchange rate be at the end of the year if the bulls break through this barrier? It may rise to July levels: 1.12.

What will the euro exchange rate be in 2023? Investor Sentiment

FXStreet Forecast Poll surveyed traders. According to the collected data, it will be difficult for the “bulls” to level the situation. Throughout the study, buyers were in the lead.

Bears are showing a decline in interest. At the same time, participants’ expectations generally remain at the level of 1.06 at a monthly distance. In quarterly reviews, traders expect 1.07–1.08.

Moving averages show different data. The short went up. Longer indicators, on the contrary, are weaker in predicting a fall.

Trader sentiment generally remains at 1.06–1.09. In the coming month, prices may consolidate in the range of 1.04–1.07.

The euro exchange rate and the future. What happens next?

The French bank BNP Paribas says: the exchange rate of the euro-dollar pair was not what it was expected to see after the ECB’s statements in September. It has become more stable as the global economy has slowed. The movement in portfolio investment showed that investors are converting euros into other financial assets less than usual in such situations.

At the same time, BNP Paribas said: euro-denominated energy resources may soon become more expensive. Causes:

- energy shocks;

- deterioration in terms of trade due to supply restrictions.

Against this background, in the fourth quarter of 2023 and next year, the euro may lose value.

If earlier BNP believed that in December the euro-dollar pair would trade at 1.10, now the forecast is more pessimistic – 1.07. At the same time, according to the bank, next year the euro currency will strengthen its position against the dollar to the level of 1.15.

CIBC expects a strong dollar to take a position at 1.03 in December 2023. When the Fed starts cutting rates, it will weaken to 1.09 by the middle of next year.

According to RBC, by the beginning of next year the euro’s position will fall to 1.04. By June it may even drop to 1.02. The Fed will not cut rates quickly to slow down price growth amid a normally functioning economy. In addition, the recent rise in the euro will not be able to reverse the downward trend that has been gaining momentum over the previous few months.

ING says: the euro-dollar pair is trading above the real level by 1%. An undervalued financial asset may lose even more value during a correction based on market factors.

At the same time, ING believes that the trend may reverse in the near future. After a drawdown to 1.06 by the beginning of 2024, an increase to 1.18 by the middle of the year will be visible.

Euro to ruble. Where will the course go?

The Russian Federation adopts a strict regulatory policy. Over the past few months, the ruble has been losing value. The reason is that exporters did not pay taxes, postponing until October. The inflow of foreign currency into the budget was lower than expected. But in October the ruble began to strengthen.

Do not forget that sellers of hydrocarbons must keep 80% of their foreign currency earnings in Russian banks. 90% needs to be exchanged for rubles. This contributes to the unnatural strengthening of the currency.

The interest rate in the country is also rising. The last time she added 2% at once: she reached 15%. But due to the lag, the rate increase will affect the value of the euro only after a few months.

Experts were divided into 2 camps. Some expect the government to:

- will tighten currency control measures;

- In the endwill regulate market.

Then the euro may roll back to ₽ 98, because no one will need it. Why have a currency you can’t do anything with?

The second group of experts assures: if the Russian authorities do not tighten currency control measures, the euro may rise in price to 120-130 rubles by the middle of next year. But the likelihood of such a scenario happening is extremely low.

If the government does start to weaken the euro, this would be a great time to buy it and transfer it abroad. This way you can protect your assets from further regulatory measures. But some expect that the withdrawal of currency abroad will be prohibited.

💻 News about TON coin: the future of The Open Network in connection with […]

🆘 The fall of the cryptocurrency market: what is it connected with crypto collapse […]

💰 News about withdrawing money from the slipper Tap_sport Telegram – tokenomics and earnings […]

🔍 News about withdrawing money from KuroroRanch: earning methods, listing and premarket 🟥 Kuroro […]

🆕️ News about withdrawing a token from a cryptocurrency application Doginhood crypto: How does […]

🆕️ News about token withdrawal and premarket of the game SnakeTON: how to get […]