New investment tools — crowdlending and crowdfunding

Previously, the business attracted investment from banks and large investors. The situation has changed greatly in recent decades.

First came crowdfunding, the crowdlending. This has significantly expanded 🔓 opportunities for entrepreneurs and startup creators. More for ordinary people. The latter got a chance to finance projects that were really interesting to them and make money from it.

⏳ It is difficult to understand what “crowdfunding” is, “crowdlending”? 😵 Rating Forex will explain in detail and clearly. We can also do it for free get a personal solution which will bring profit. See for yourself ✔️.

What is crowdfunding?

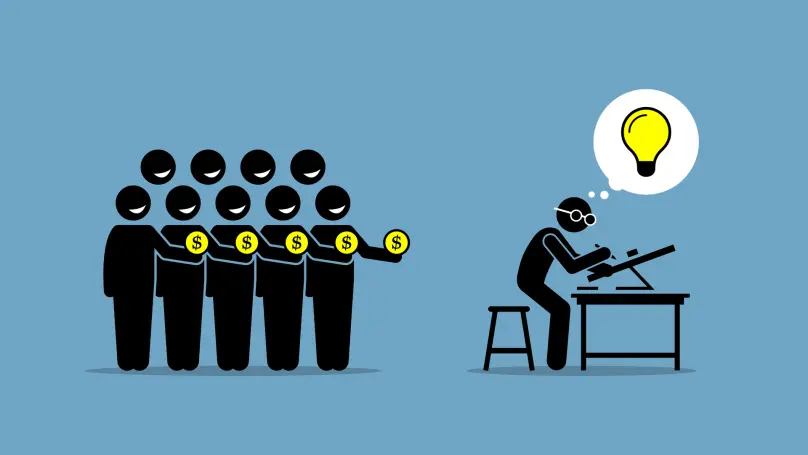

Crowdfunding is a collective collection of finances 💰 for the implementation of a project in the social, scientific, commercial, and charitable spheres. Fundraising is carried out on special platforms.

Thanks toWith crowdfunding, a business receives additional funding for launching, developing, modernizing, releasing a new product or promoting an existing one.

In addition, crowdfunding is a powerful 💪 brand promotion tool. It promotes PR and marketing.

Business announces itself to a wide audience. This helps to find new employees, clients, partners and investors. The media very often talk about interesting projects that collect investments through crowdfunding.

⏳ This approach to attracting finance is a kind of marker of the prospects of the project. If it is interesting, solves real problems, a lot of people will invest in it 💰.

How does crowdfunding work?

There are 3 parties involved in the process:

- 🟢 Founders. Those who are looking for capital or have submitted a project. Not only the owner can be a founder. The first successful crowdfunding took place in 1997. Then fans of the band Marillion 🎤 raised money to organize her tour across the United States. Moreover, the performers themselves did not take part in the process. The proceeds were $60,000. The musicians recorded several albums with them.

- 🟢 Backers. Individuals and legal entities investing money in the project. They are known as sponsors, investors, donors.

- 🟢 Crowd platforms. Special platforms on the Internet, whose function is mediation between founders and investors. It is on crowd platforms that information about fundraising is posted. There he goes. Such platforms are entitled to a commission for mediation 💰.

To launch a project, the founder:

- 📌 Sets a goal. You need to understand what exactly the money is being collected for. It is important that the goal is very specific, measurable and achievable.

- 📌 Determines the required amount of money. It is necessary to calculate absolutely all expenses for the implementation of the task, take into account the commission of the crowdfunding site, taxes. It is important to understand what exactly the founders will receive as a reward.

- 📌 Sets the collection period. You cannot endlessly ask for money to implement a project. Few people will agree to this. There are exceptions. And quite famous. It is only with years of constant begging without keeping promises that their reputation gets worse.

- 📌 Determines the promotion model. This could be your own web resource, the media, bloggers, mailings, real-life events, social networks, or just word of mouth. Ideally, all of these options are used.

- 📌 Selects the appropriate platform. The project must meet its goals and rules. Some have more stringent requirements. Others work strictly for charity. There are differences in the work model. Some sites return money to founders if the required amount is not raised by a certain date. Others pass on everything they managed to collect.

We need to create a crowd project. This is a description 📝 of what exactly the company is going to do, in what time, for what purpose.

About crowdfunding, you need to understand that this is an attempt to attract the attention of ordinary people and persuade them to give money. There are not enough dry calculations and charts 📈 that are offered to professional investors.

Potential backers from the people may not understand what you want to do. Sincerity, honesty and emotional response are key factors for a successful project.

⏳ To spur the interest of future investors, they need to offer them a nice gift 🎁 or a bonus. Perhaps something unique. What investors in a project can get at the crowdfunding stage. This could be anything from a souvenir pen to the name of a game character in honor of a major contributor.

Crowdfunding. What can investors get?

Initially, crowdfunding was mostly free of charge 😮. People supported a product that generated interest and response.

Over time, mass investing began to develop. Founders began to offer more significant rewards than words of gratitude and nominal gifts.

Based on the reward, there are several types of crowdfunding:

- ✏️ Donations, donations. Investors give money for free. This is acceptable when implementing personal, non-profit, charitable projects.

- ✏️ Valuable prizes. Souvenir products, exclusive models of the financed product. Such rewards are most often used at the pre-sale stages of project development.

- ✏️ With the involvement of debt capital. In exchange for the capital raised, the founders eventually share percentage of the profit received.

- ✏️ Equity crowdfunding. In exchange for financing, the investor receives a stake in the project. This is offered to large investors. Fundamentally, equity crowdfunding is shares. But listing of securities is optional.

Equity crowdfunding is called crowdinvesting. It has long become a separate type of fundraising. In demand among professional investors and investment companies.

Where to invest in Russia? Crowdfunding platforms for Russians

Crowdfunding has long been regulated in the Russian Federation. Including Federal Law No. 259. Therefore, everyone has a legal chance to invest in a startup and get something for it.

Although crowdfunding accounts for only 0.15% of all investments in Russia, it continues to develop 💪. The country has 71 official platforms that give startups a chance to raise capital from the public.

By law, unqualified investors have the right to invest up to RUB 600,000 per year. There are no restrictions for qualified individuals.

In 2023, almost 55,000 projects were registered in the Russian Federation 🆕. The field of crowdfunding is developing and improving. More than 2% of investors invest this way.

There are 4 large platforms for mass investments in the Russian Federation. The biggest one is Planeta.ru. It was founded in 2012 and does not attract capital to commercial projects or politics. Usually they collect for charity or something related to creativity.

Planeta.ru has one feature. If 50% or more of the required amount is collected, the founder receives capital minus a 15% commission. This is relevant only if he guarantees: he will fulfill his obligations. If 100% or more has been collected, the collection is reduced to 10% ⬇️.

Boomstarter is another big, old platform from 2012. It focuses on technological and business projects and is used to finance social and creative initiatives. It’s an all-or-nothing scheme. If the required capital is not collected, the money is returned to the backers ↩️.

In 2014, “City of Money” started. This is a platform for crowdfunding A. Here individuals lend to businesses. You can set the commission amount. City of Money charges 3–6% for its services.

“Potok” has been operating in the Russian Federation since 2015. Its format isP2B. That is, the business is financed by individuals. Legal entities can also invest.

Foreign platforms where Russians can invest:

- ✅ Indiegogo (2008). You can invest money in creative, charitable, personal projects. The founders receive everything they managed to collect. Commission – 9%.

- ✅ Kickstarter (2009). The platform appeared a year later than Indiegogo, but was the first to gain mass popularity. Here they invest money in commercial projects in the fields of creativity, science, and production. The audience is large. Capital drips quickly. But the “all or nothing” scheme works.

- ✅ AngelList (2010). Here they invest in IT startups. Most of the money comes from business angels. Such people want to invest in a promising business with the hope of reselling their share in it. One of the top examples is Uber.

- ✅ Crowdfunder (2011). Money attracts creative, interesting business projects. There are startups without specific goals. Commission – 5%.

There are smaller sites on the Internet. But they extremely rarely can offer conditions better than those listed above.

What’s happened crowdlending

Crowdlending is a type of crowdfunding. This collective investment option involves lending. As a rule, they lend at higher interest rates than in a bank 🏦. Can reach up to 25% per annum.

The reason for the high percentages is that at the startup stage and other early stages of development the company is most vulnerable. There is a high risk of collapse and bankruptcy.

⏳ Due to the high interest rate, investors are protected from risks. If one of the investments turns out to be unprofitable, the income from the rest will cover all losses ✔️.

Money attracted to crowdfunding platforms. They have different requirements for projects. Legal entities and individual entrepreneurs who:

- 🔶 work for more than 10–12 months;

- 🔶 have no dark spots in their credit history;

- 🔶 regularly replenish their bank account.

Investment platforms more loyal compared to banks. But they must make sure that the business is real before they let it in. Therefore, they need to provide an extract from the Unified State Register of Legal Entities, Unified State Register of Individual Entrepreneurs, bank and financial statements.

Founders:

- Create an investment project.

- They indicate what maximum ⬆️ and minimum ⬇️ amount they want to receive.

- Determine the acceptable percentage of financing.

Backs can choose projects in which they are willing to invest capital.

Formally, to create an application, it is enough to provide only basic data about the business. But it is desirable to evoke a response from investors. Therefore, the more details of interest, the higher the likelihood of funding.

When the site collects the required amount of money, it is transferred founder. She is waiting for him to return the money with interest and commissions.

⏳ If payments are late, fines, penalties, and penalties will be assessed. As a last resort, investors may demand to repay the debt through the court ❗. So it is a safer way to invest than crowdfunding.

You can make money from both crowdlending and crowdfunding. With crowdfunding, it is better to invest small amounts. Crowdlending suitable for powerful 🔋 investments.

💻 News about TON coin: the future of The Open Network in connection with […]

🆘 The fall of the cryptocurrency market: what is it connected with crypto collapse […]

💰 News about withdrawing money from the slipper Tap_sport Telegram – tokenomics and earnings […]

🔍 News about withdrawing money from KuroroRanch: earning methods, listing and premarket 🟥 Kuroro […]

🆕️ News about withdrawing a token from a cryptocurrency application Doginhood crypto: How does […]

🆕️ News about token withdrawal and premarket of the game SnakeTON: how to get […]